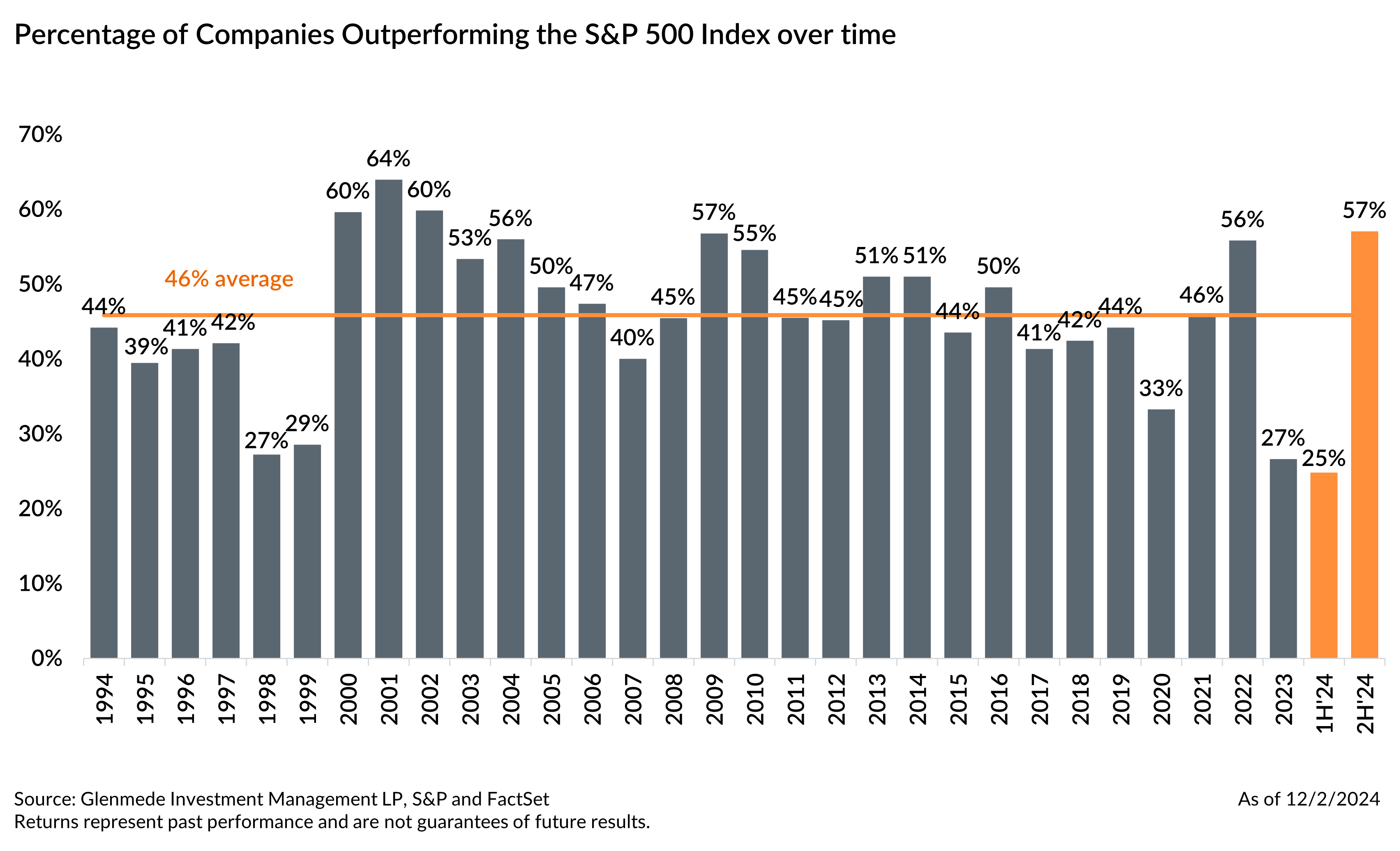

Market Snapshot: S&P 500 Participation Trophy Is a Second Half Story

While U.S. market concentration remains high, index constituent participation caught fire in the second half of the year. As shown in the chart, 2023 saw just 27% of S&P 500 companies outperform the index, the lowest number in a 30-year period. The start of 2024 seemed poised for a repeat, when only 25% of companies outperformed the index through the first half of the year. The second half of the year, however, tells a very different participation story with 57% of constituents outperforming the index, well above the 30-year average of 46% (annualized).

Concentration of the S&P 500 remains at historic levels with the top six stocks1 accounting for about 30% of the index by weight. These six stocks contributed 62% of the S&P 500 return for the first six months of 2024,2 but that share has decreased in the second half of the year. As of November 30, 2024, these six stocks have accounted for approximately 43% of the S&P 500 return3 for 2024. In other words, the S&P 500 has been experiencing broader market participation outside of the “heavyweights” in the second half.

We believe diversification remains a cornerstone of robust portfolio construction over full market cycles. As these passive indices become less diversified, the benefits of owning a diversified index decline. Exposure to a concentrated large cap passive strategy offers favorable returns when the top weights are outperforming. But with signs of broader market participation occurring, the concentration — or lack of diversification — becomes a potential headwind to performance relative to more diversified large cap portfolios. We continue to believe diversifying some U.S. large cap passive exposure to a less concentrated active strategy offers an attractive risk/reward.

1The top six weighted names of the S&P 500 are Apple Inc., Microsoft Corporation, Alphabet Inc., Amazon.com, Inc., NVIDIA Corporation, and Meta Platforms, Inc. Tesla, Inc. has dropped from the “Magnificent Seven” term used predominantly in 2023 to group the top seven weights of the S&P 500.

2 NVIDIA Corporation was the largest contributor within these top six weights with half of the top six contributions or almost 33% of the total return attributed to this one stock.

3 NVIDIA Corporation continued to the be largest contributor within these top six weights with almost half of the top six contributions or 21% of the total return attributed to this one stock.

Views expressed include opinions of the portfolio managers as of December 12, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. This is not intended as a solicitation for any service or product. All investment has risk, including risk of loss. Designed for professional and adviser use.