Market Snapshot: Russell Rebalancing Into More Concentrated Growth

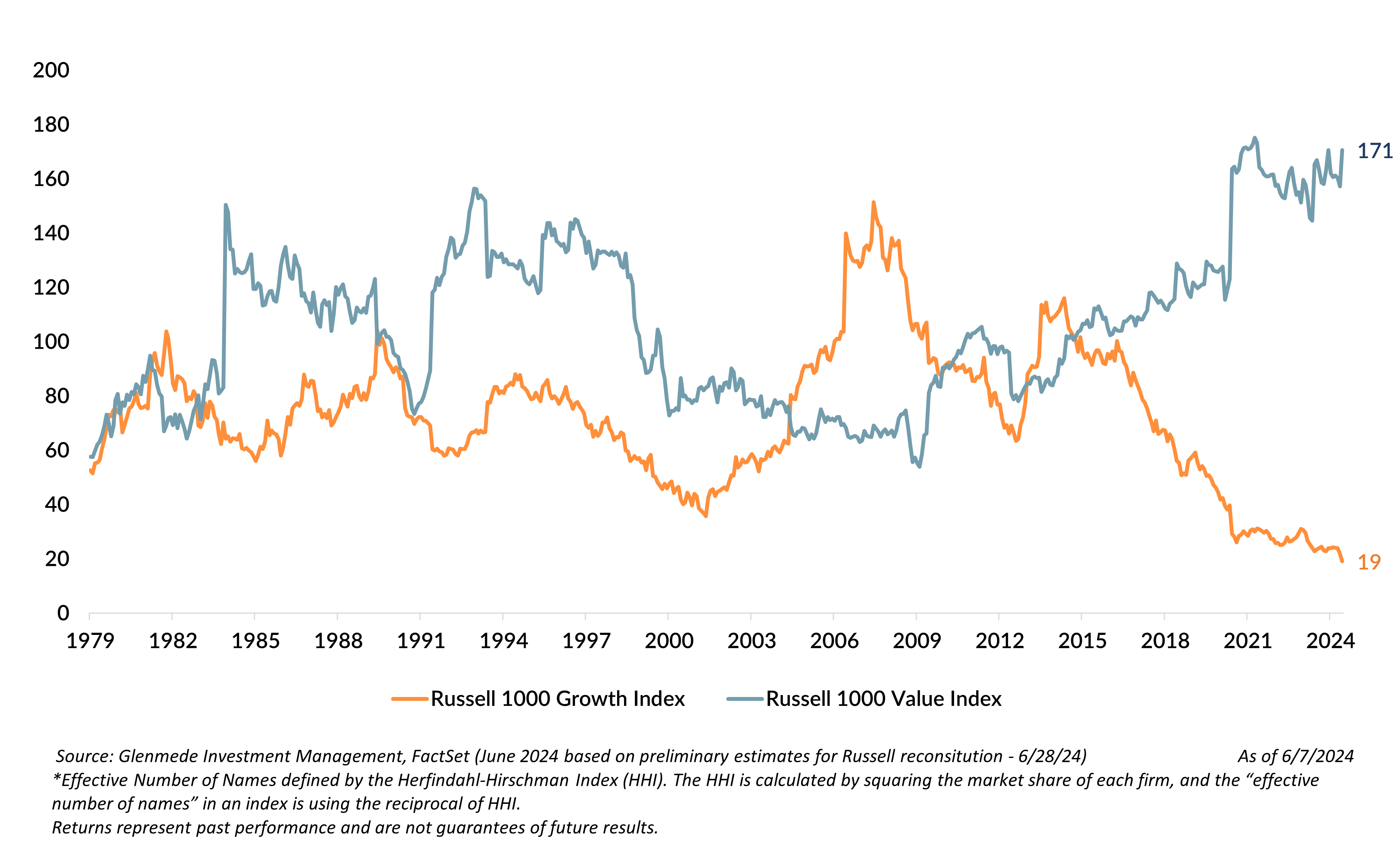

Effective Number of Names* – Russell 1000 Growth vs. Value Indexes

Preliminary data ahead of the Russell rebalance scheduled for June 28 suggests the Russell 1000 Growth Index will be less diversified than at any other point in its history. To keep the overall market values of the growth and value indices about par, the number of constituents in the Russell 1000 Growth Index is projected to decrease from 439 to only 394 (the lowest since 1979), and the Russell 1000 Value Index is projected to increase constituents from 846 to 871 (the highest since 1979). As a result, the Russell 1000 Growth Index will become even more “top heavy,” with 10 names comprising about a 62% weighting in the index. As shown in the chart, using the Herfindahl-Hirschman Index (HHI),* the “effective number” of names in the index will decline to a record low of about 19. Conversely, the Russell 1000 Value Index will become more diversified, with the “effective number” of names in the index increasing to about 171 (HHI).

Preliminary data suggests the greatest sector exposure increase from the Russell 1000 Growth Index to be Information Technology, from 45.9% to 48.7%, and Health Care the largest decrease, from 10.2% to 8.3%. The expected shift should increase the Health Care exposure in the Russell 1000 Value Index from 14.2% to 15.8%, while the Financials exposure of Value will decrease from its current 22.7% to 20.9%. The top four sectors in the Russell 1000 Growth Index are projected to account for 83.9% of the index, an increase from 82.9%. The top four sectors in the Russell 1000 Value are estimated to remain at about 60.5% of the index.

The increase in concentration for the Russell 1000 Growth Index supports our belief that while market cap-based indices may offer a reasonable representation of the broader stock market performance over time, there are periods where the structure creates concentration risk for investors. That risk is escalating after this rebalance. Passive indices typically do not have guardrails to control individual stock or sector exposures, and the companies with the highest weights have the highest market valuations. To maintain the higher weights, these companies’ future earnings growth will need to exceed that of their competitors or experience multiple expansion before those earnings are realized. Either can add potential risk and volatility to a portfolio. We believe diversifying some of this exposure to actively managed large cap growth strategies that are well diversified with limits on individual stock exposures and reflect favorable characteristics, including valuations, fundamentals and technical, may help reduce the unprecedented concentration risk of the Russell 1000 Growth Index while creating a more robust large cap growth allocation through a full market cycle.

*The Herfindahl-Hirschman Index (HHI) is a common measure of market concentration. The HHI is calculated by squaring the market share of each firm, and the “effective number of names” in an index is using the reciprocal of HHI.

Views expressed include opinions of the portfolio managers as of June 20, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.