Negative Earners Could Create Positive Alpha for Active Strategies

Over the past 35 years, the small cap universe has had cyclical periods when negative earners outperformed positive earners. We define a negative earner as any company without earnings over the trailing 12 months. With the unprecedented monetary and fiscal support over the past few years, the small cap Russell 2000 Index component stocks have been in one of those cycles, with negative earners outperforming positive earners. As of year-end 2021, roughly 35% of the Russell 2000 comprised negative earners, slightly off the all-time high of 38% earlier in the year and well above the average of 19.5% since August 1993 when sector data became available.

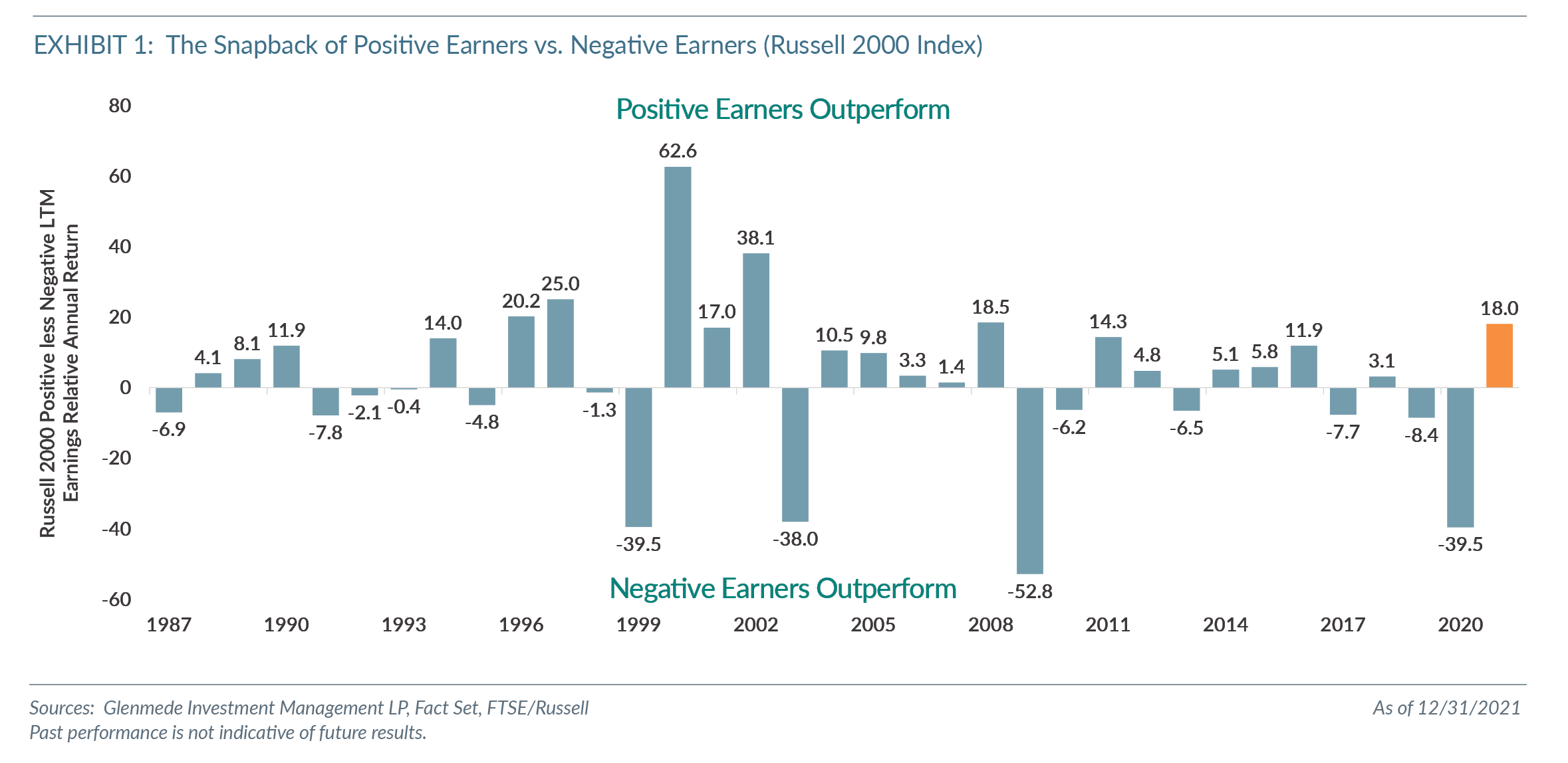

Prior periods in which investors have shunned companies with positive earnings in favor of more speculative issues have tended to be resolved by considerable downside mean reversion for the negative earning basket. 2020 represented an historic level of outperformance by negative earners, while 2021 showed a substantial mean reversion in favor of companies with positive earnings.

Exhibit 1 takes a closer look at the relationship between positive and negative earning companies for full-year 2021. It is interesting to note that negative earners did not see a material share price degradation. Instead, they simply lagged their positive earning peers. If prior market experience holds true, a substantial share price decline of this speculative basket could be in the cards.

We believe this regime of negative earner outperformance may have peaked at the end of June 2021. The second half of 2021 saw a notable shift in favor of positive earners, something we anticipate will continue into 2022. From 2016 to 2021, negative earners outpaced positive earners with an annualized return of 13.6% for negative earners versus 9.7% for positive earners. Specifically, from December 31, 2016 through June 30, 2021, negative earners outperformed positive earners by more than 2 times (20.9% annualized return for positive earners versus 10.0% annualized returns for negative earners). In second-half 2021, negative earners declined 20% from midyear highs and positive earners increased 3.3%.

Historically, investing in positive earning companies has proved more profitable than investing in negative earning companies. Using the longest available history for which we have usable data for the Russell 2000 Index (since December 31, 1986), positive earners have experienced almost 2.5 times the annualized return with less than two-thirds the risk (annualized return for positive earners of 10.6% versus negative earners with 4.4% and standard deviation since of 19.4% versus 32.9%, respectively).

A significant portion of this longer-term outperformance of positive earners is the avoidance of the large drawdowns following market bubble bursts like the internet bubble in the early 2000s and the global financial crisis in 2008. Given the notable rally of negative earners following the unprecedented monetary and fiscal support during the COVID-19 pandemic, we believe we are at the start of a more noteworthy divergence in performance of these stocks and continue to favor positive earners. A passive index like the Russell 2000, and to a lesser extent the S&P 600 Small Cap Index, is more likely to have greater exposure to these negative earners than actively managed strategies that prefer undervalued, higher quality stocks and therefore could experience underperformance during this cyclical shift back to positive earners.

During the internet bubble, negative earners saw 4 times the annualized returns of positive earners from August 1998 to February 2000 (84% versus 21%, respectively), only to have those returns wiped out within 15 months and notable underperformance for the three-year period from February 2000 to February 2003 (-43% annualized versus 4%, respectively). While the financial crisis of 2008 did not see the same level of outperformance prior to the peak, negative earners experienced notable underperformance during the broader market drawdown.

We believe small cap stocks entered the correction phase of the negative earners’ outperformance in second-half 2021 and could continue to see relative weakness in these names throughout 2022. Given the concentration of negative earners in the Russell 2000, we continue to believe passive investors could experience notable underperformance during this cycle shift. Therefore, we prefer actively managed strategies focused on higher quality, undervalued companies.

Any opinions, expectations or projections expressed herein are based on information available at the time of publication and may change thereafter, and actual future developments or outcomes (including performance) may differ materially from any opinions, expectations or projections expressed herein due to various risks and uncertainties. Information obtained from third parties, including any source identified herein, is assumed to be reliable, but accuracy cannot be assured. This paper represents the view of its authors as of the date it was produced, and may change without notice. There can be no assurance that the same factors would result in the same decisions being made in the future. In addition, the views are not intended as a recommendation of any security, sector or product. Returns reported represent past performance and are not indicative of future results. Actual performance may be lower or higher than the performance set forth above. For institutional adviser use only, not intended to be shared with retail clients.

The Russell 2000 Index is an unmanaged, market value weighted index, which measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market. One cannot invest directly in an index.