Market Updates

November 07, 2023

Market Snapshot: The Potential Climb of Yields to Un-Inversion

The Climb to Un-Inversion

- The inversion of the U.S. Treasury yield curve has generated much debate about an impending recession, and with reasonable precedent. According to data from the Federal Reserve Bank of San Francisco, an inverted yield curve has foreshadowed all ten recessions since 1955, with only one false positive in the mid-1960s. An inversion is counterintuitive to risk – an investor receives a higher yield for lending money for a shorter amount of time rather than a longer amount of time. Inversion suggests investor concerns of an economic slowdown pushing the longer term yields lower, as well as increased expectations of interest rate cuts from the Federal Reserve which would eventually lower the yield on the short end and normalize the curve.

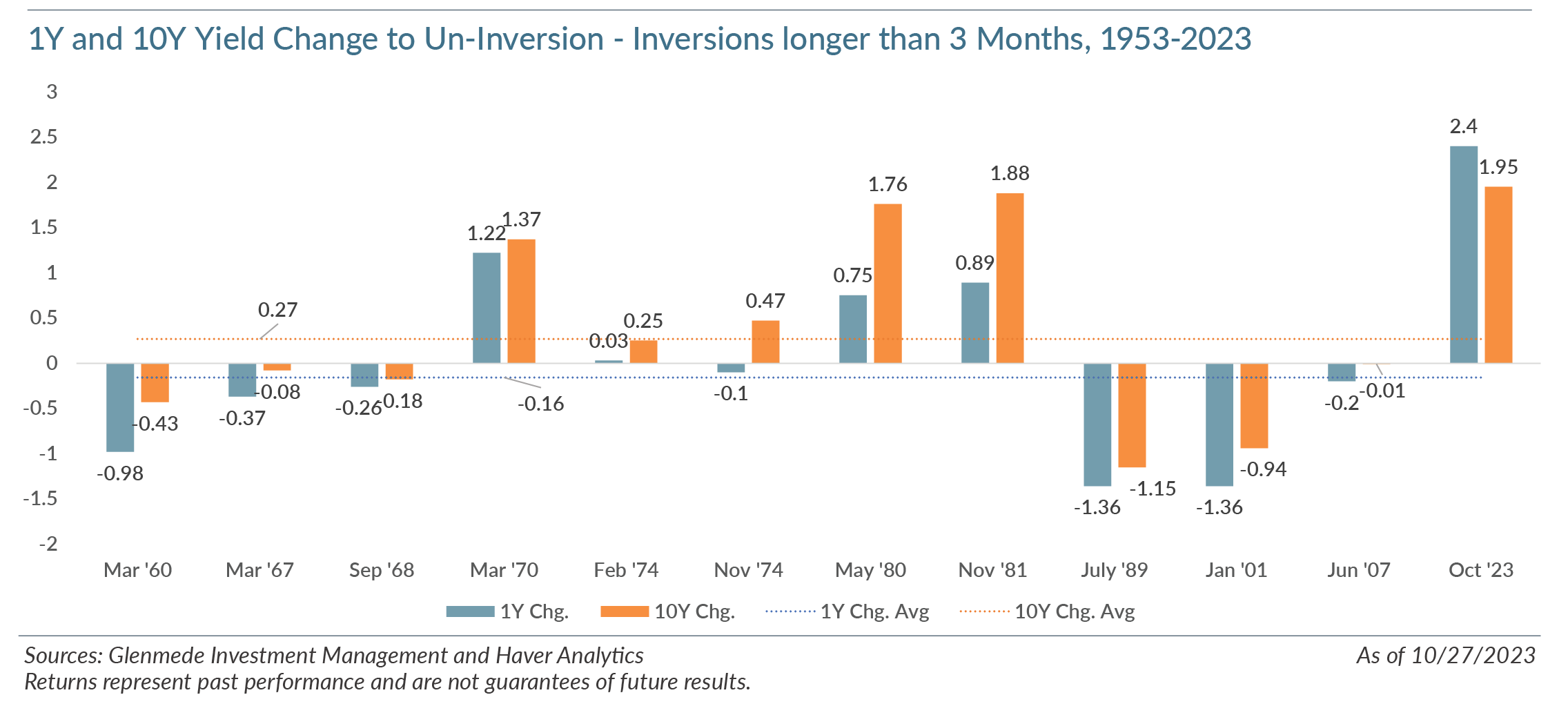

- Instead of debating the likelihood of a recession, we compare the behavior of the yield curve during the “un-inversion,” when long-term rates go above short-term rates. Comparing monthly data from 1953 to present, we chart the change in the yield of the U.S. Treasury 1Y and 10Y yields from the month inversion first occurred until the curve normalized. Please note, we use 1Y yields for the longer time history, and we fully acknowledge that the current environment has not normalized so this period may still be subject to change. Interestingly, the chart shows that six of the past 12 inversions have seen the 10Y yield increase into the normalization process, with five of the 12 also seeing the shorter end increase. During the 1970s and 1980s, a period with increased inflationary pressures, the yields primarily increased to normalize the curve. Meanwhile, the more recent period produced an environment where both short and long-term rates have decreased to normalize the curve, primarily because of Federal Reserve interest rate cuts and a potential economic slowdown.

- While we have not seen this cycle’s inversion return to normal, we believe the past 40 years of rate inversions may not tell enough of the story to conclude that rates should be expected to move lower to have the curve become upward sloping. While continued concerns of inflation and expectations of higher for longer remain, we have questions about the assumption that yield curve normalization must follow the same pattern as we’ve seen in 40 years of a low inflationary and declining rate regime. Rates can climb their way out of an inversion. In fact, on average, the 10Y yield ROSE to end an inversion, while the 1Y fell. To say that the current inversion is unusual with rates rising would be true…if we only pay attention to the past 40 years.

Views expressed include opinions of the portfolio managers as of September 28, 2023, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.