Market Snapshot: September Brings Market Falls, December Brings Santa Rallies

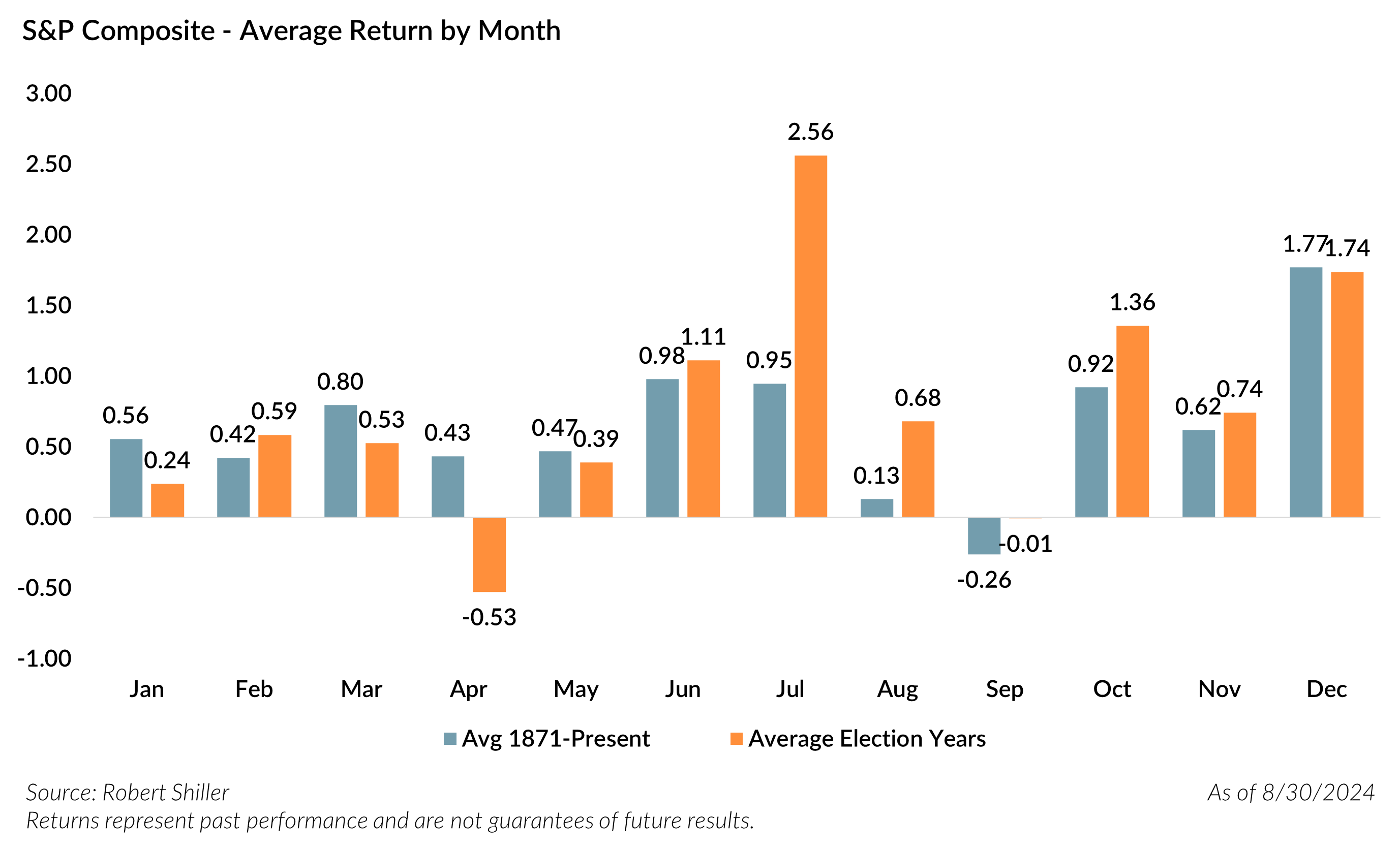

Our analysis of S&P Composite returns from 1871 to Present – a span of over 150 years – shows that September has been unmistakably the weakest month of the year for equity markets, as seen in the chart above. The average monthly return over all periods was about 0.65%, which would compound to about 8.1% per year. Roughly 61% of all months within this timeframe had positive returns.

Meanwhile, September is the only month with a NEGATIVE average return over that long timeframe (-0.26%). Positive returns did occur 51% of the time, making it the only month that was a virtual toss-up in terms of direction. Interestingly, election years have had little impact on this phenomenon, as September was still the only month with an average negative return over the past 38 election cycles. While September has been the weakest month, the good news for investors is that, again on average, September’s weakness has been offset by market strength in the fourth quarter. Since 1871, the December rally has averaged 1.77% with a 71% positive frequency, making it by far the strongest month.

Interestingly, the S&P performed similarly in December regardless of September’s direction: it’s returned 1.71% and 1.79% when September was up and down, respectively, suggesting that there may be a larger seasonal pattern leading to a better average entry point in the fall. While market timing is a fool’s errand for investing, we believe the appreciation of the evidence of mean reversion over market cycles should also provide some comfort from panic selling for longer-term investors.

[1] Statistical Note – January, with a positive frequency of 55.8% and August at 56.5%, are just outside the 5% confidence interval for a random coin flip, but still highly unlikely to be a 50% probability. December’s return is roughly 2.95 standard errors above the return for an average month, while September’s is 2.4 standard errors below, making these months’ returns highly unusual.

Views expressed include opinions of the portfolio managers as of September 26, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. This is not intended as a solicitation for any service or product. All investment has risk, including risk of loss. Designed for professional and adviser use.