Market Snapshot: Why the Cyclicality of R-Star Keeps our Bands of Uncertainty Wide

Analyzing the neutral rate of interest (r-star)¹ by dividing the history into cycle regimes of approximately 20 years shows a stronger statistical relationship to real interest rates than using one homogenous period. The existence of regimes below or above the neutral rate should lead investors to widen the bands of uncertainty around the probability of Fed cuts this year. Investors should also reexamine the likelihood of an imminent recession when the real interest rate exceeds r-star. We believe we may have entered a new regime where the real interest rate can consistently hover above the neutral rate for a prolonged period without triggering a recession — as it did in the 1980s and 1990s.

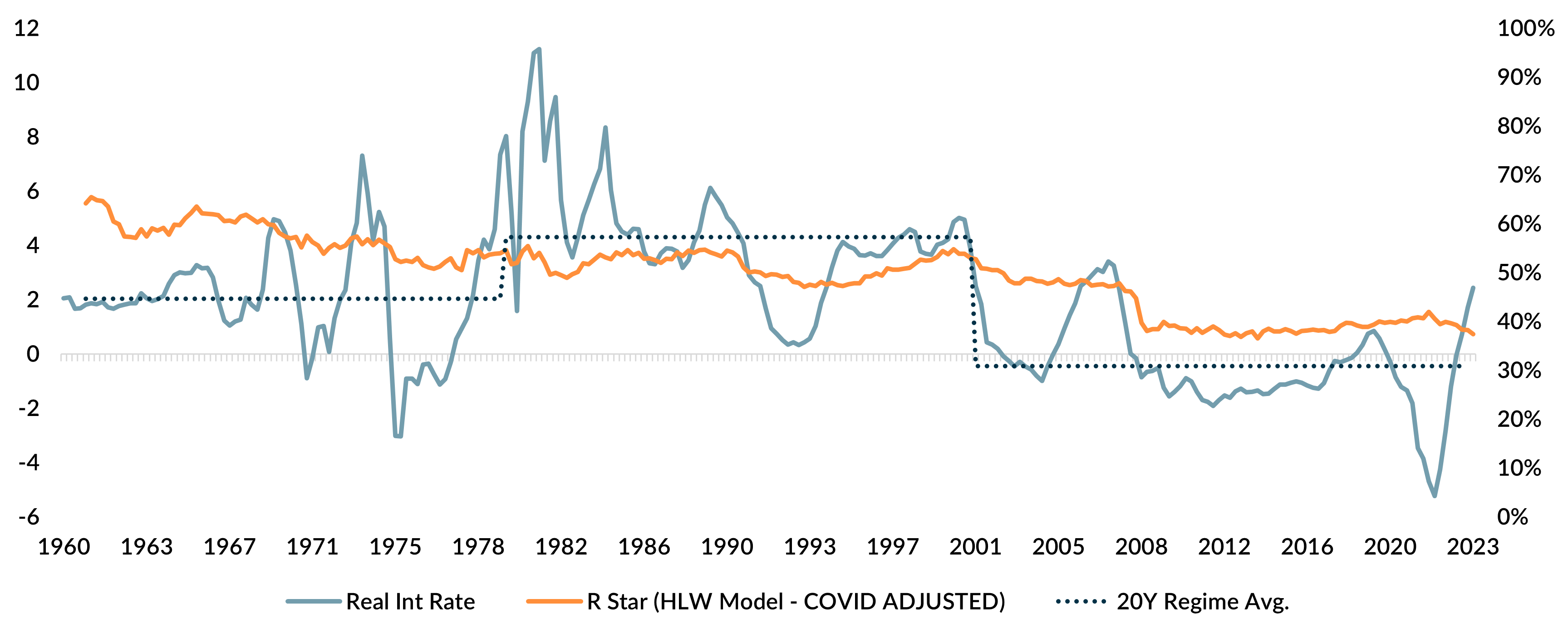

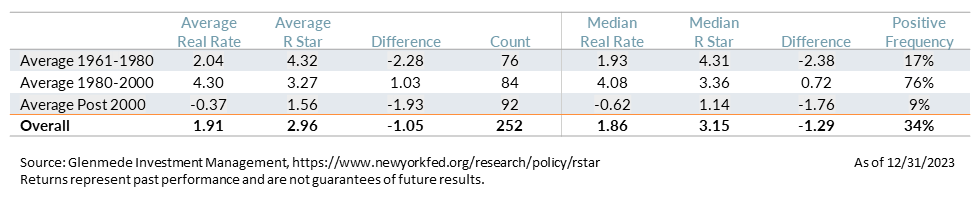

The chart compares the COVID-adjusted Holston, Laubach, Williams (HLW) model from 1960 through October 2023 to the real interest rate over this same period, with historical recessions noted in gray. The historical correlation of the HLW model to real interest rates is 0.56, suggesting a reasonable long-term relationship, yet with still a significant amount of unexplained movement. If we divide the periods into three regimes (1961-1980, 1980-2000 and post-2000), the correlation increases appreciably to 0.71. As noted in the table, these three regimes are approximately 20-year cycles, alternating between periods of the neutral rate being above real interest rates (1961-1980 and post-2000) or below (1980-2000).

The chart shows that recessions generally happen after the interest rate peaks above the neutral rate. However, the middle regime reveals that the fed funds rate spent most of the 1980s and half of the 1990s above the neutral rate without a recession. The final interest rate peaks before the savings and loan crisis and the end of the internet bubble eventually resulted in an economic downturn, but a recession call when these interest rates crept above “normal” would have been years early. Ultimately, we believe a prolonged period of real interest rates above the neutral rate is highly probable, given the cyclicality of r-star to real interest rates over time. This potential regime shift widens our bands of uncertainty around any possibility of Fed cuts or imminent recession because we believe the likelihood of cuts and recessions is more relevant to the regime than recent history.

¹The neutral rate of interest (r-star) is the estimated short-term interest rate that is neither contractionary nor expansionary for the economy. The value is an estimate with the Holston, Laubach, Williams (HLW) calculation being an often-cited value. Given the Federal Reserve’s ability to control short-term interest rates with the fed funds rate, a target rate above or below the neutral rate of interest is thought to be a lever to cool a hot economy or stimulate a slower economy. This suggests the r-star can serve as a guidepost for monetary policy, with many strategists currently calling for a recession on the back of “lagging effects” of having real rates rise above neutral.

Views expressed include opinions of the portfolio managers as of May 30, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.