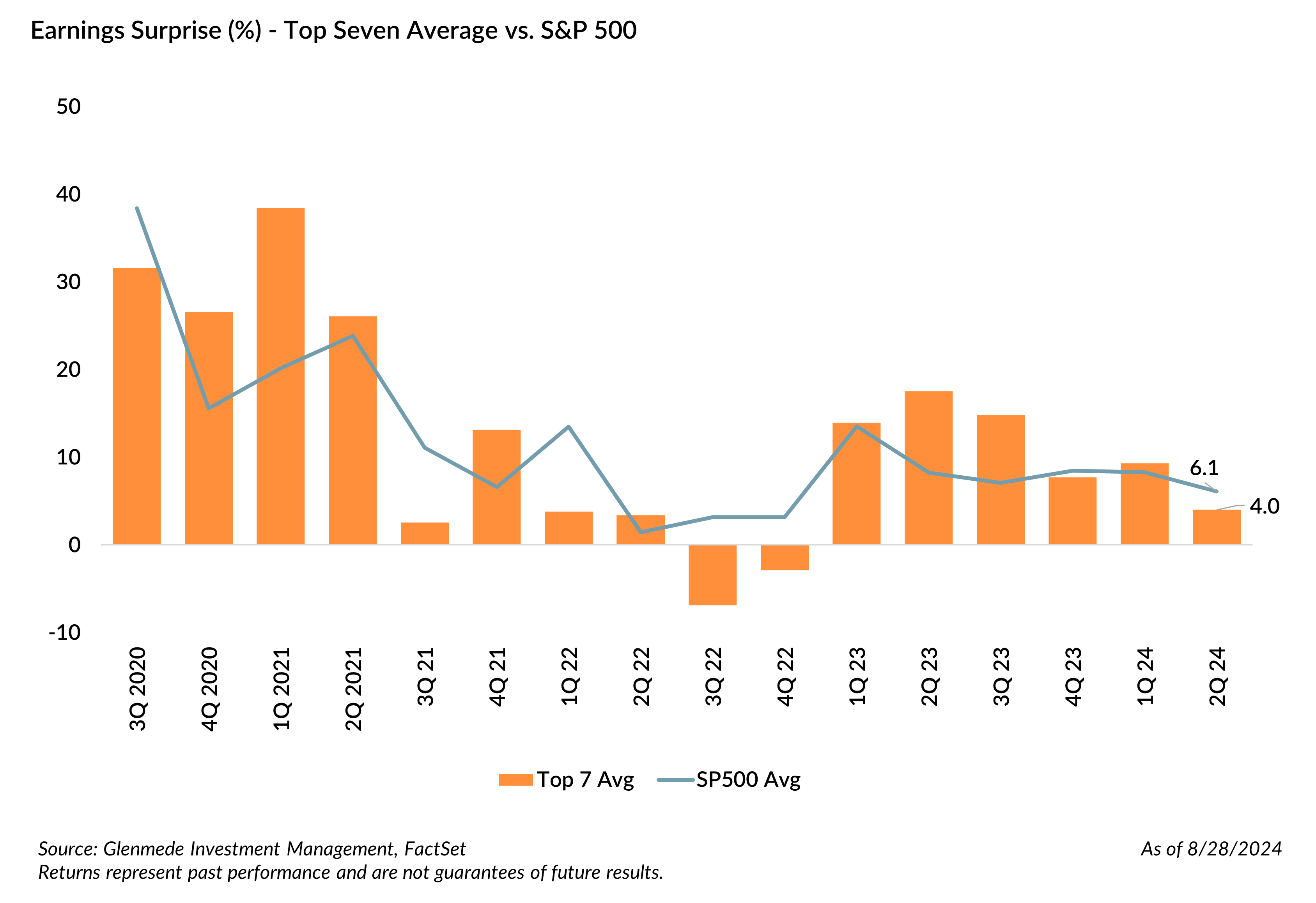

Market Snapshot: Magnificent Seven’s Less Than Magnificent Earnings Surprises

While the Q2 2024 earnings season has been favorable for U.S. large cap stocks, the Magnificent Seven1 (Mag 7) earnings surprises failed to maintain their magnificence relative to the average stock. Specifically, 80% of U.S. large cap companies beat EPS estimates by an average of 6.0%. Although six of the Mag 7 companies also beat consensus estimates, their surprises were the smallest since Q4 2022 and the first time their surprise was below the benchmark since then.

This quarter may signify an end of the earnings acceleration in AI stocks. Much like the “Stay at Home” theme in the lockdowns of late 2020 and early 2021, and the electric vehicle runup in late 2021,2 the AI boom so far has provided a one-year boost in earnings surprises that seems to be gradually waning. As there is no apparent theme likely to take its place among the Mag 7, the recent broadening of earnings surprises to a wider market leadership may persist. There is statistical evidence to support this resilience, with the average Mag 7 stock showing about a 30% quarter to quarter correlation3 in earnings surprises in the post-COVID timeframe.

Given the market concentration of passive U.S. large cap indices,4 a lack of diversification away from the Mag 7 as earnings surprises are cooling may create risks for passive investors. We believe the broader participation of earnings strength relative to the Mag 7 continues to create opportunities for active large cap strategies that would likely be tilted towards stocks with lower valuations and underweight the concentrated stocks.

1 Magnificent Seven (Mag 7) are Apple Inc., Microsoft Corporation, Alphabet Inc., Amazon.com, Inc., NVIDIA Corporation, Tesla, Inc. and Meta Platforms, Inc

2 For a discussion of the stay at home stocks bubble, see for instance: https://www.forbes.com/sites/sergeiklebnikov/2021/12/03/is-the-era-of-stay-at-home-stocks-over-heres-why-zoom-peloton-and-others-have-slumped-in-2021/ For a discussion of the Electric Vehicle (EV) stock bubble, see for instance: https://www.barrons.com/articles/ev-stock-bubble-burst-investors-trillion-35de621f

3 Average correlation of quarterly earnings surprises with a 1-Quarter lagged series, among Mag 7 companies.

4 Based on year-end data from 1964 to present, the top five components by weight of the S&P 500 Index reached a record accounting for 28.6% at Q2 2024, surpassing the 1964 record of 27.7%3. From 1964 until 1993, the top five weights steadily declined to 10.7%, with an average weighting over the past 60 years of 16.5%. For additional reading, please see our Q2 Quarterly Statement.