Market Snapshot: Is Small Cap Momentum Just Getting Started?

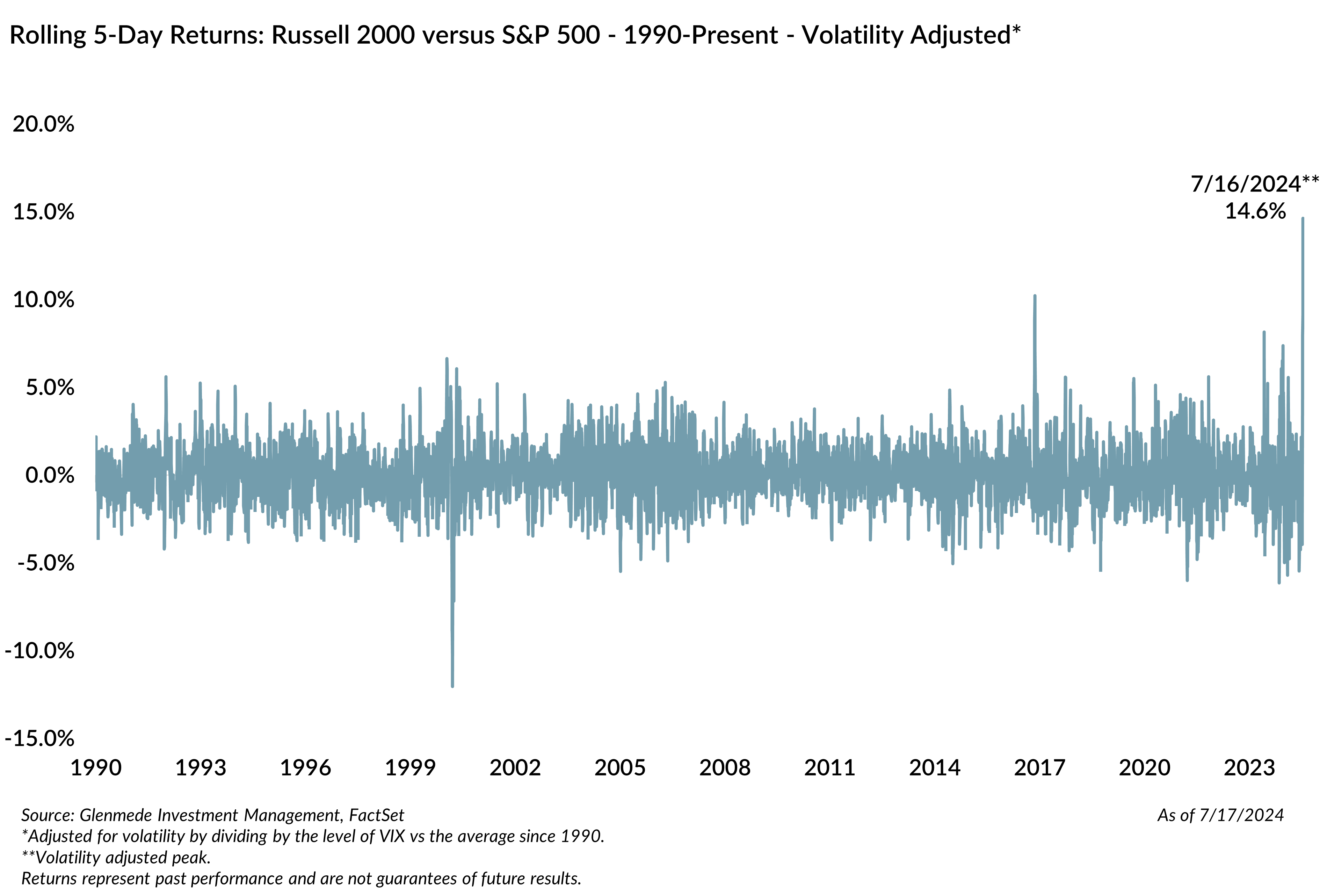

On July 17, 2024, small cap stocks (Russell 2000 Index) experienced the largest five-day outperformance over large caps (S&P 500 Index) in at least 34 years.¹ While the absolute value of the outperformance alone is notable, adjusting the five-day outperformance to account for volatility delivers an even more impressive magnitude. In other words, the extent of the outperformance was not driven by broader market volatility as measured by the CBOE Volatility Index (VIX), currently at levels below the longer-term averages. As the chart shows, the five-day volatility-adjusted² relative return of the Russell 2000 versus the S&P 500 saw an outperformance of 14.6% as of July 16, 2024, an 8.9 standard deviation move, surpassing the record of 10.6% on November 15, 2016.

Of the previous 14 observations when the absolute outperformance of small cap relative to large cap exceeded 6.0% in a five-day period, the next month saw continued outperformance for small cap with an average of 1.2% and a 57% positive frequency. While momentum can be a friend for forward returns, we believe valuation starting points are important considerations for future returns.

Given that 41% of Russell 2000 constituents were negative earners³ as of Q2 2024, we look to the S&P 600 as an alternative for a small cap proxy for valuation. The S&P 600 includes a profitability filter and we believe is therefore a better representation of the higher quality small cap universe. As of quarter end, the forward price-to-earnings ratio of the S&P 500 was trading at a 47% premium to the S&P 600, in the 98th percentile since 1994 and above the 30-year average of -5.3%.

While we cannot predict if this most recent outperformance is the start of a longer-lasting small cap outperformance cycle, we have been arguing it is possible.⁴ The first two weeks of July should be a reminder that reversions can turn quickly,⁵ and investors sitting on the sidelines risk missing out on much of the reversion trade. Even if this is not the start of the new small cap regime, we continue to argue that higher quality small caps offer an attractive risk/reward relative to passive large caps as the relative valuations are attractive. We believe an increase in a small cap allocation has earned its way into the conversation.

¹ Based on data since 12/31/1989, the Russell 2000 outperformed the S&P 500 by 10.0% on July 17, 2024. The Russell 2000 had its largest outperformance over the large cap Russell 1000 since the inception of both indices in 1979.

² Volatility adjusted uses the VIX at the peak of the small cap outperformance and adjusts for the long-term average of the VIX to adjust for broader market volatility that could increase daily moves during each time period.

³ We define a negative earner as any company without earnings over the trailing 12 months.

⁴ Please see our Q1 2024 Quarterly Statement, Leaning into Equal Weight and Small Cap, and our Q4 2023 Quarterly Statement, It’s a Small World After … 2023.

⁵ Value tends to have a median return close to zero, with most of the information in the tails. For instance, all of the return from the Fama-French value factor over the past 60 years can be explained within the 4% of months with the best return. Source: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

Views expressed include opinions of the portfolio managers as of August 1, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.