Market Snapshot: An Equal Opportunity Market

We have repeatedly discussed the increase in market concentration¹ for U.S. large cap stocks and the potential concentration risk for investors in large cap passive strategies. The weighting in the S&P 500 of the “Magnificent 7” (Apple Inc., Microsoft Corporation, Alphabet Inc., Amazon.com, Inc., NVIDIA Corporation, Tesla, Inc. and Meta Platforms, Inc.) was 28% as of December 31, 2023, and contributed to 62% of the total return of the index for 2023. We continue to believe this concentration is cyclical and will revert in the years to come, with many investors over-exposed to this risk given the shift to passive large cap allocations.

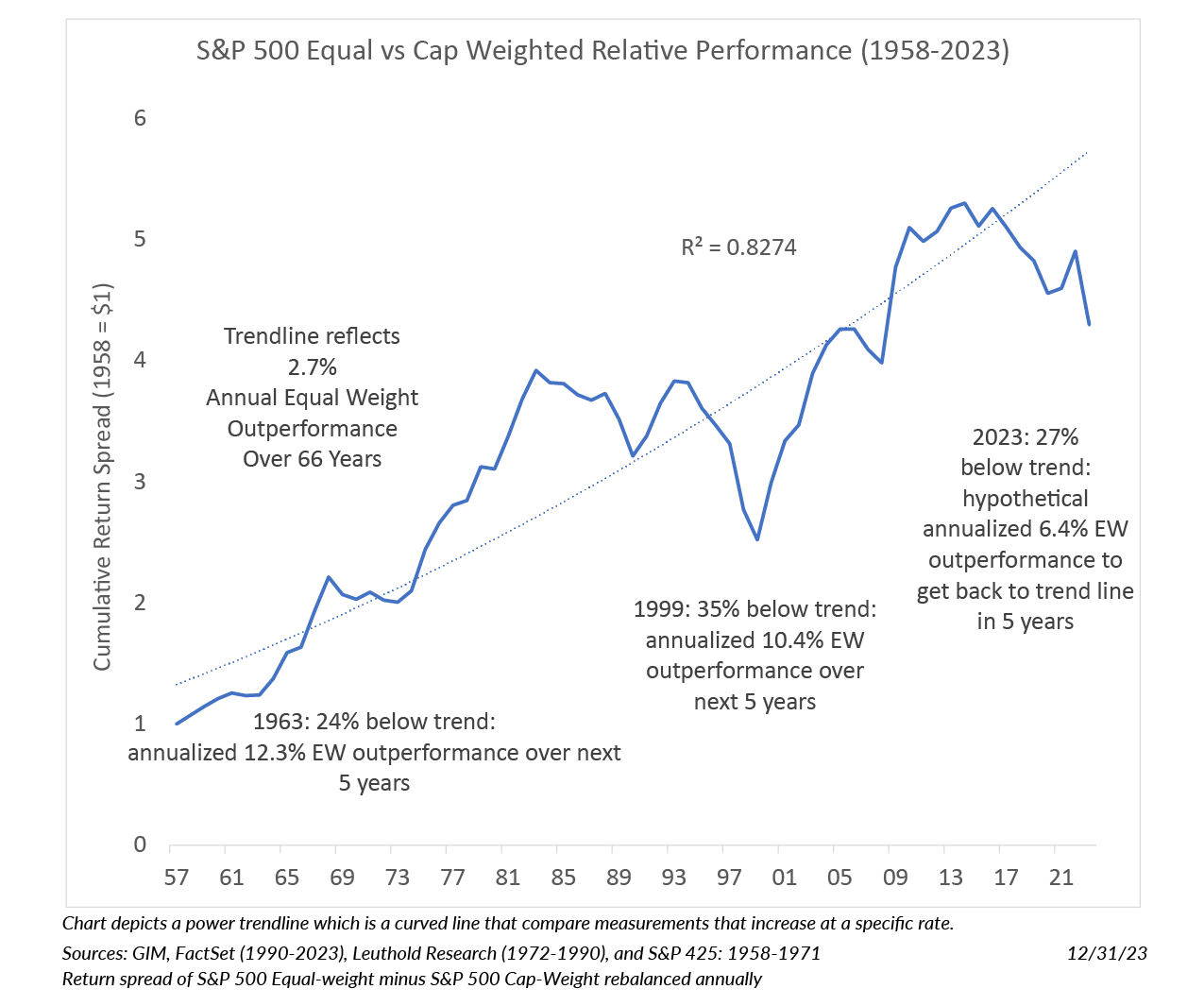

The chart looks at the growth of $1 of the S&P 500 Equal Weight versus Cap Weight since 1958 through 2023, rebalanced annually. As of December 2023, the relative underperformance of equal weight versus cap weight has fallen to 27% below the trend line, the third period in the past 66 years to see such a divergence from trend. The trendline implies equal weighted outperformance by about 2.7% per year, with a strong fit (82.7% R squared). The other two comparable drawdowns to today were in 1963 and 1999, after which the equal weighted S&P outperformed by 12.3% and 10.4% per year for five years, respectively (cumulative 5Y relative returns were 78% and 64%). Theoretically, just to get back to trend, the S&P equal weighted index would need to outperform by 6.4% per year over the next five years.

Calling turning points is always difficult, but we are near the maximum drawdown from trend that markets have experienced in the last 66 years. This level of deviation historically has been the strongest argument towards mean reversion over the next three to five years. We believe allocating to strategies with a more equal weighted approach offers diversification from concentration risk and the potential period of underperformance of the market cap passive indices in the next three to five years.

Footnote 1: Please see our Q2 2023 Quarterly Statement, “Concentration…64…No Repeats…Or Hesitation“, and May 2023 white paper, “Concentration Traps of Equity Indexing.”

Views expressed include opinions of the portfolio managers as of December 31, 2023, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.