Tariff Update

Big Tariffs on the Table

- The announcement of a 90-day pause on reciprocal tariffs is a considerable (albeit temporary) weight lifted from a tariff program that is unprecedented in both scale and scope.

- The highlights include 125% China tariffs, 25% Canada/Mexico tariffs, 25% product-specific tariffs (e.g., steel/aluminum, autos, etc.), 10% baseline tariffs and country-by-country reciprocal rates ranging from 15 – 49%.

- If tariffs are reinstated after the pause, several Asian nations such as Vietnam, Taiwan and Japan will face average duties of over 20%. China tariffs are the exception, which are less likely to see a reprieve.

- Effective tariff rates are expected to spike higher to Smooth-Hawley levels, resulting in the largest tax increase since at least 1940 that was not intended to fund an ongoing war effort.

Potential Economic Impact

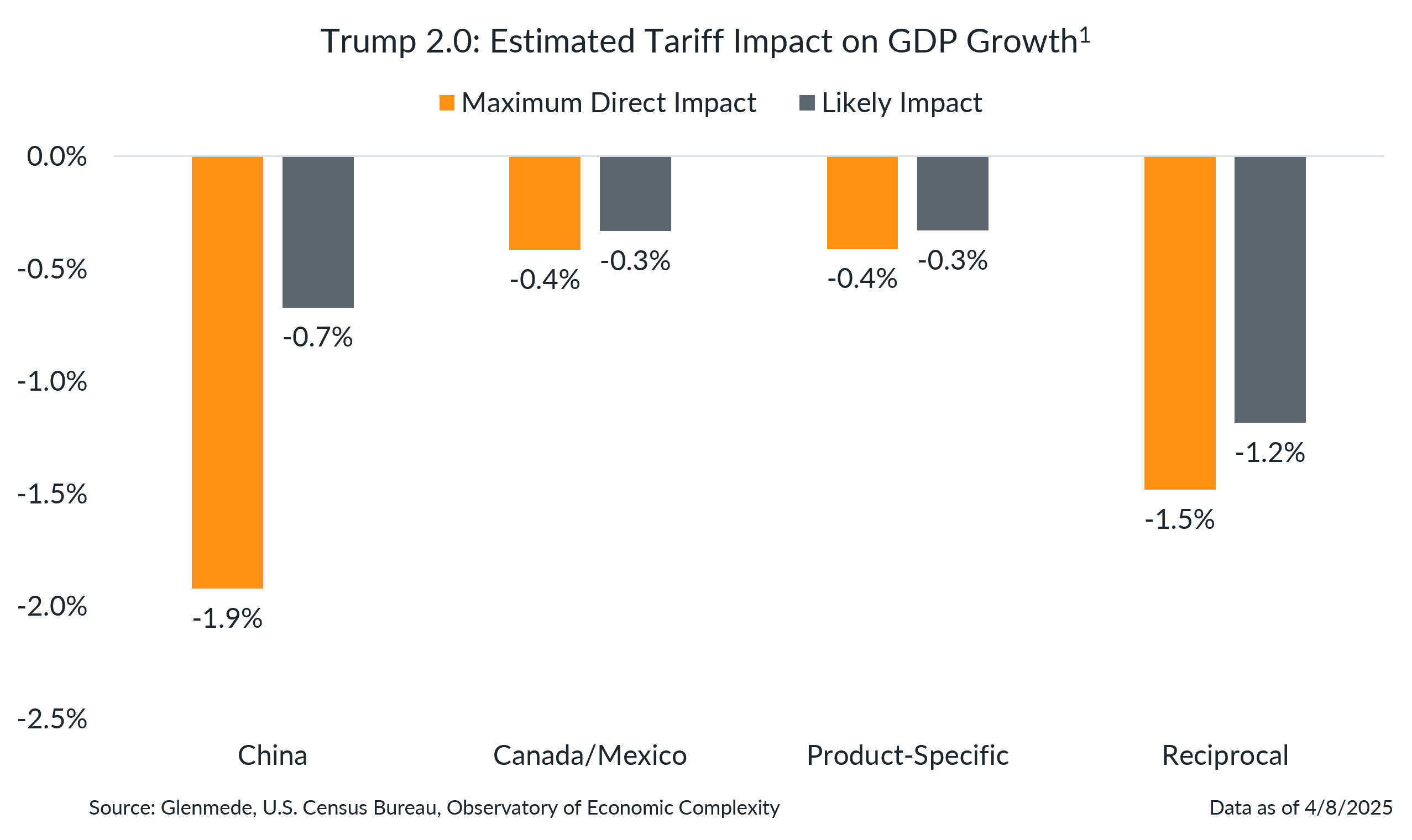

- By our estimate, new tariffs proposed this year are expected to result in a headwind to economic growth of ~2% if implemented fully as announced.

- Given the sweeping and all-encompassing nature of these tariffs, the extent to which companies may be able to adjust supply chains and mitigate some of the impact is notably constrained, though the pause may give firms some runway.

- In a sense, these tariffs resemble an event-driven economic shock similar to the COVID-19 pandemic, when traditional leading indicators offered little guidance for making timely calls on the economy’s direction.

- The tariff headwind is expected to bring near-term GDP growth closer to the 0% line and lift recession odds closer to a coin flip (our estimate of the probability of recession this year has roughly doubled from 20 – 25% to 40 – 50%).

The Potential Paths Forward

- Although reciprocal tariffs have been paused for now, considerable uncertainty remains over the path forward due to the potential of court challenges, status of tariffs after the pause and fiscal/monetary policy offsets.

- Usage of the International Emergency Economic Power Act is likely to face challenges in court, but there are other ways the President could pursue tariffs that are likely to hold up to legal scrutiny (Section 301, 232, 338 authorities).

- Countries that rely on U.S. trade or have low leverage may rush to cut their tariffs and other barriers in hopes of receiving better terms of trade, which would soften the economic impact. Much of Asia ex-China may take this path.

- Other nations may feel the need to respond in-kind with higher tariff rates of their own, fueling the fire a while longer in a tit-for-tat trade war. China, the European Union and Canada may take this path to varying degrees.

- This may provide the impetus for Congress to accelerate and beef up the reconciliation bill that has been in the works, which could provide some needed fiscal stimulus as an offset. The tariff pause provides some breathing room on timing.

- The Fed may find itself caught between a rock and a hard place, with tariffs raising the risk of stagflation. If inflation appears to be the greater concern, the Fed may adopt a more cautious approach to rate cuts this year.

- If it becomes clear that the risks to economic growth are growing starker and begin to outweigh inflation concerns, the Fed may be much more willing to cut rates aggressively.

An aggressive tariff approach could lead to an aggregate impact of ~2% of GDP

1Estimated tariffs reflect the tariff rate applied fully to all associated imports and are shown as a percent of gross domestic product (GDP). China tariffs includes 91% country-specific tariffs as well as the revoked De Minimis exemption for imports from China and Hong Kong. Canada/Mexico includes 25% tariffs for USMCA non-compliant imports with a carveout 10% rate for Canadian energy. Product-Specific refers to tariffs on steel, aluminum, copper, lumber, automobiles and parts, pharmaceuticals, semiconductors and European alcohol. Reciprocal refers to global baseline 10% tariffs (except for Canada and Mexico) as well as higher country-specific levies that account for other countries’ tariffs, value-added taxes (VATs), currency manipulation and other non-monetary barriers to trade. The maximum direct economic impact of proposed tariffs assumes full demand destruction via a tariff-induced price shock and that tariffs are implemented fully and in isolation, with no changes to the sourcing of the imports, no other offsetting policies and no retaliatory tariffs. Likely impact accounts for offsetting factors such as reconfigured supply chains and substitution effects. Actual results may differ materially from expectations or projections.

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.