Market Snapshot: 2025 Volatility Du Jour

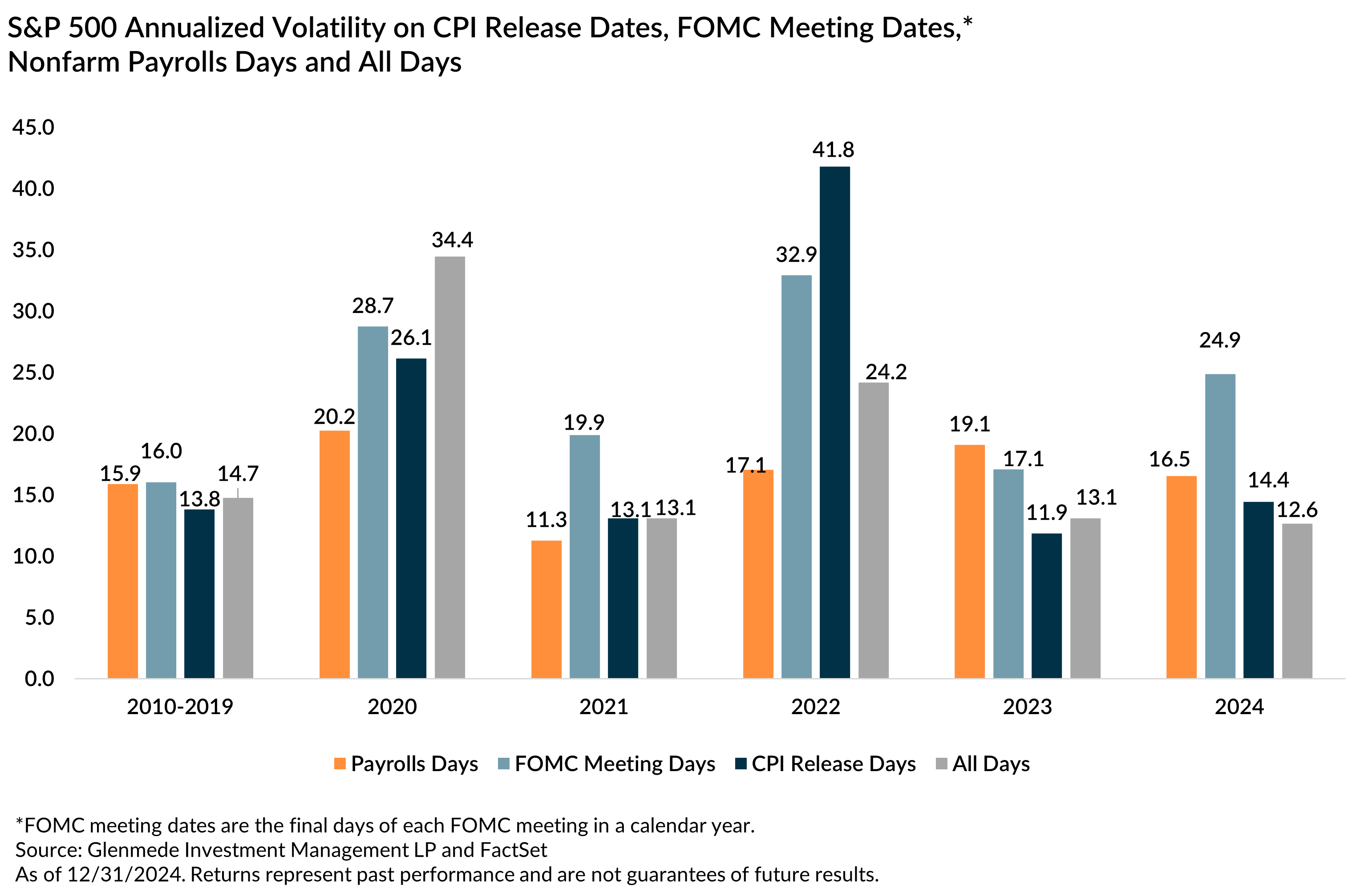

From 2010 to 2019, release dates for nonfarm payroll (NFP), Federal Open Market Committee (FOMC) meetings and Consumer Price Index (CPI) announcements didn’t experience unusual volatility as measured by the S&P 500. On the whole, those release dates experienced fairly similar volatility to all other trading days in those respective years, with NFP and CPI release days slightly more volatile. Over the past five years, however, each of these release dates has experienced a single year with the highest daily volatility, reflecting different investor concerns. As we are in a new investing year and administration, which of these announcements is likely to be a driver of market volatility?

For historical context, the chart shows the events over the past several years that have been market drivers of volatility. During 2020, with the onslaught of and uncertainty surrounding the pandemic, all trading days experienced increased relative volatility. In 2021 investor concern was elevated around FOMC meeting dates, with those days having he most volatility. By 2022 the concern that inflation may not be transitory increased, and the CPI release days experienced the highest volatility. At the start of 2023, investor uneasiness shifted to the increasing risk of a recession, with payrolls becoming the more volatile days of trading as investors digested every report to tweak recession probabilities. As recession fears faded in 2024, investor focus was dominated by Federal Reserve rate decisions as to when and how long the pivot from higher rates to lower rates may happen.

Moving into 2025, the days with the most volatility have been around both NFP and CPI, suggesting markets are continuing to focus on data points surrounding the Fed pivot. Surprisingly, markets have experienced average volatility on days when President Trump has addressed his planned agenda. Our expectation is that daily volatility may remain more extreme on data points that drive the Fed’s decisions on rate changes. However, we recognize that headlines surrounding tariffs could be a catalyst for increased investor anxiety around President Trump’s agenda days and lead to increased volatility across all trading days.

Views expressed include opinions of the portfolio managers as of February 6, 2025, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. This is not intended as a solicitation for any service or product. All investment has risk, including risk of loss. Designed for professional and adviser use.