Market Snapshot: Election Out, Small Cap In

In the week following the 2024 U.S. election, with results of a strong Republican wave,1 small cap indices almost doubled the rally of large cap indices, reaching new highs for the first time in three years.2 We believe this rally is justified for more than just the political landscape shift, and it still has room to run. In our view, allocating to higher quality, attractively valued, profitable small cap companies is appealing relative to large cap passive strategies.

The broader U.S. market rally post-election is likely due, in part, to investor sentiment that the Republican wave could lead to a more business-friendly environment, with lower taxes and less regulation, both of which could notably impact smaller companies. An added boost to the recent small cap tailwind was the Federal Open Market Committee’s decision to cut rates 25 basis points two days post-election. Lower rates could be viewed as more beneficial to small cap stocks because they are more likely to rely on external funding than their large cap peers, so the lower rates could decrease their interest expenses.

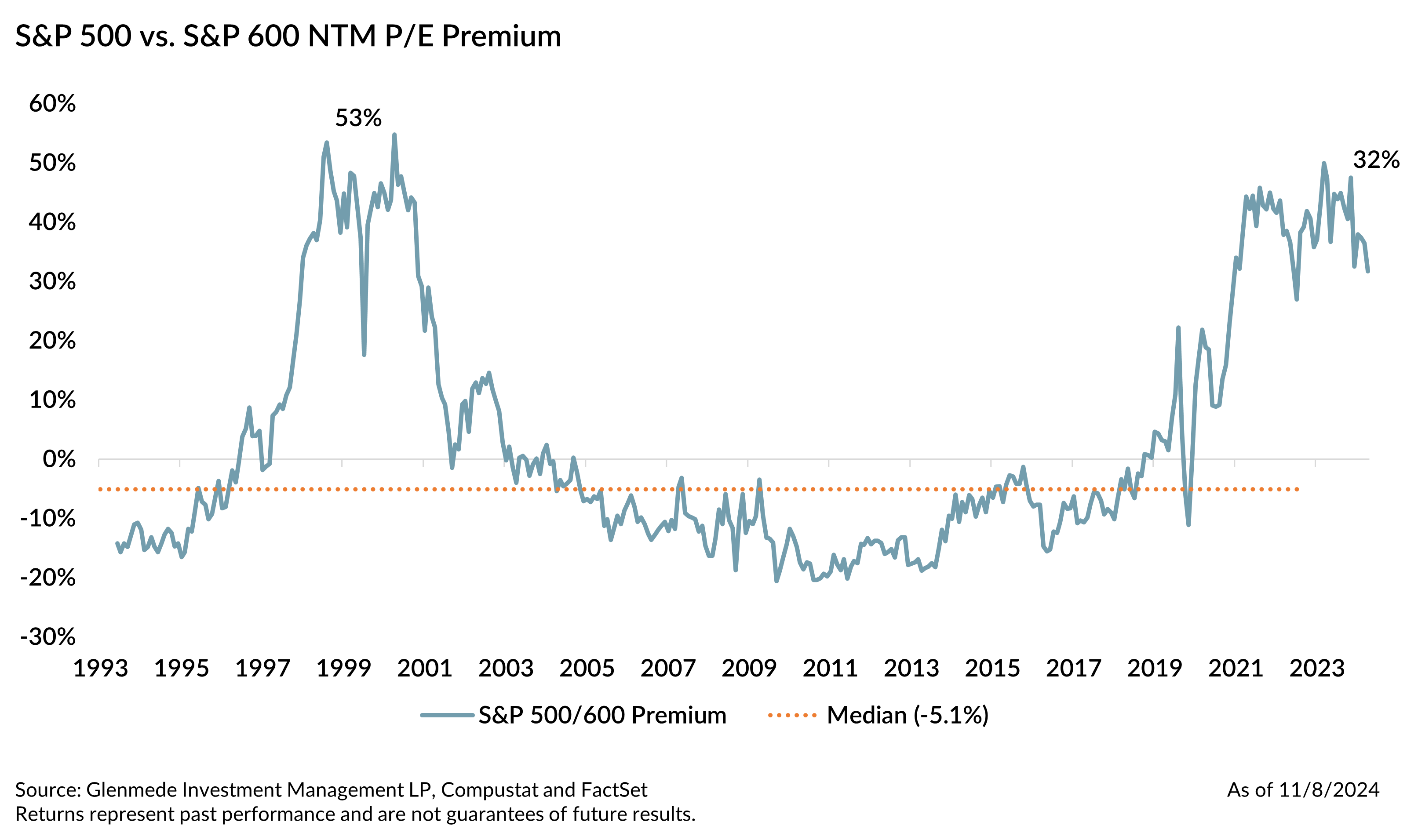

While the shift in market animal spirits has been favorable to small cap stocks post-election, they have significantly underperformed large caps for the past decade. We believe the gap is ripe to close.3 While mean reversion is one argument, valuations may be a more compelling one. As shown in the chart, inclusive of the post-election-day rally, the next 12-month (NTM) forward price-to-earnings (P/E) multiple of large cap (S&P 500) to small cap (S&P 600) is currently at a 32% premium compared to the median over the past 20 years of a 5.1% discount.4 With the potentially positive political tailwinds and the attractive relative valuations, we continue to believe that higher quality small caps offer an attractive risk/reward relative to passive large cap and have earned their way into the asset allocation conversation.

¹ As of 11/15/2024, former President Donald Trump won 312 electoral votes versus Vice President Kamala Harris’s 226. Republicans gained four seats in the Senate to realize a majority of 53 versus 47, and Republicans keep the majority in the House with some seats still yet to be called (218 for Republicans vs. 209 for Democrats).

2 From pre-election-day close (11/4/2024) to the following week’s close (11/11/2024), the Russell 2000 Index (small cap) rallied 9.8% relative to the Russell 1000 Index (large cap) rise of 5.4%. The S&P 600 Index (small cap) rallied 9.7% compared to the S&P 500 Index (large cap) rally of 5.1%. Both Russell 2000 and S&P 600 made new all-time highs for the first time in three years post-election.

3 As of 10/31/2024, large cap has outperformed small cap by 117.6% over the past decade, or 4.8% annualized (Russell 1000 returns of 231.7% cumulative and 12.7% annualized versus Russell 2000 of 114.1% cumulative and 7.9% annualized). The current period of small cap underperformance to large cap rivals the period during the internet bubble, with peak underperformance of 6.2% in March 1999.

4 We use the S&P 600 for a valuation perspective that reduces the potential valuation impact of negative earners in the Russell 2000. To remain consistent with various index methodologies, we compare the S&P 500 as a proxy for U.S. large cap to the S&P 600 as a proxy for U.S. small cap. For additional reading on this analysis, please see our Q1 2024 Quarterly Statement, Leaning into Equal Weight and Small Cap and our Q4 2023 Quarterly Statement, It’s a Small World After … 2023.

Views expressed include opinions of the portfolio managers as of November 15, 2024, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. This is not intended as a solicitation for any service or product. All investment has risk, including risk of loss. Designed for professional and adviser use.