Dividend Investing: Potential to Build Wealth & Reduce Risk

Download the PDF: GIM_Dividend Investing: Potential to Build Wealth & Reduce Risk

We believe a strategy of owning dividend-paying companies that are also successfully reinvesting in their businesses can deliver better long-term returns, with lower risk, than many other equity-based strategies. Some investors may seek gains by focusing on the highest potential growth opportunities with less emphasis on dividends, while others may try to maximize the current yield of their holdings with less focus on the growth of the business. Those strategies, however, may come with higher risks that can dilute the rewards from the success stories.

In our view, investors should seek those companies with attractive current dividend yields and the ability to profitably reinvest in their business in order to optimize the return and risk benefits from dividends.

Impact of Dividends on Returns

The total return of a stock is the combination of the change in the market price plus any dividends received. An investor, however, does not need to invest in stocks that pay current dividends to generate attractive total returns. Some of the largest companies in the market today have generated substantial shareholder wealth while paying little, or no, dividends. Berkshire Hathaway, for example, has outperformed the total return of the S&P 500 over several decades and has yet to pay a dividend.

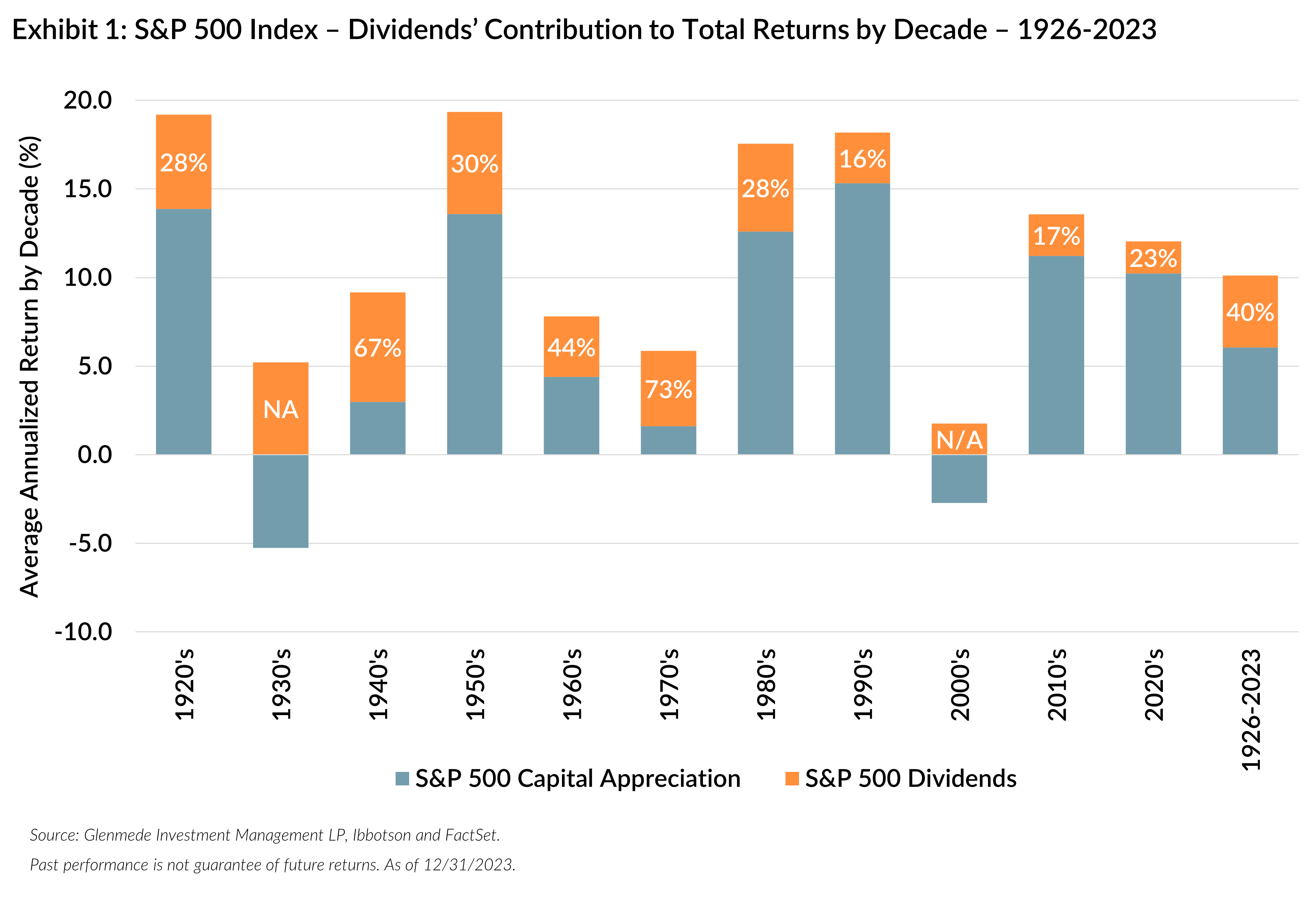

Despite stocks like Berkshire Hathaway, investors should still consider utilizing an investment strategy that focuses on companies that pay a dividend today. While the dividend contribution to the total return of the market varies, it has represented about 40% of total S&P 500 returns over almost 100 years of history, as shown in Exhibit 1.

Dividend contribution is clearly a greater portion of returns during periods when capital appreciation is modest, and a smaller share when stock prices increase more rapidly. Importantly, dividends are consistently a positive contributor. This helps act as a buffer when share prices decline and is likely part of the reason that dividend-paying stocks display lower volatility over time, as shown in Impact of Dividends on Volatility below.

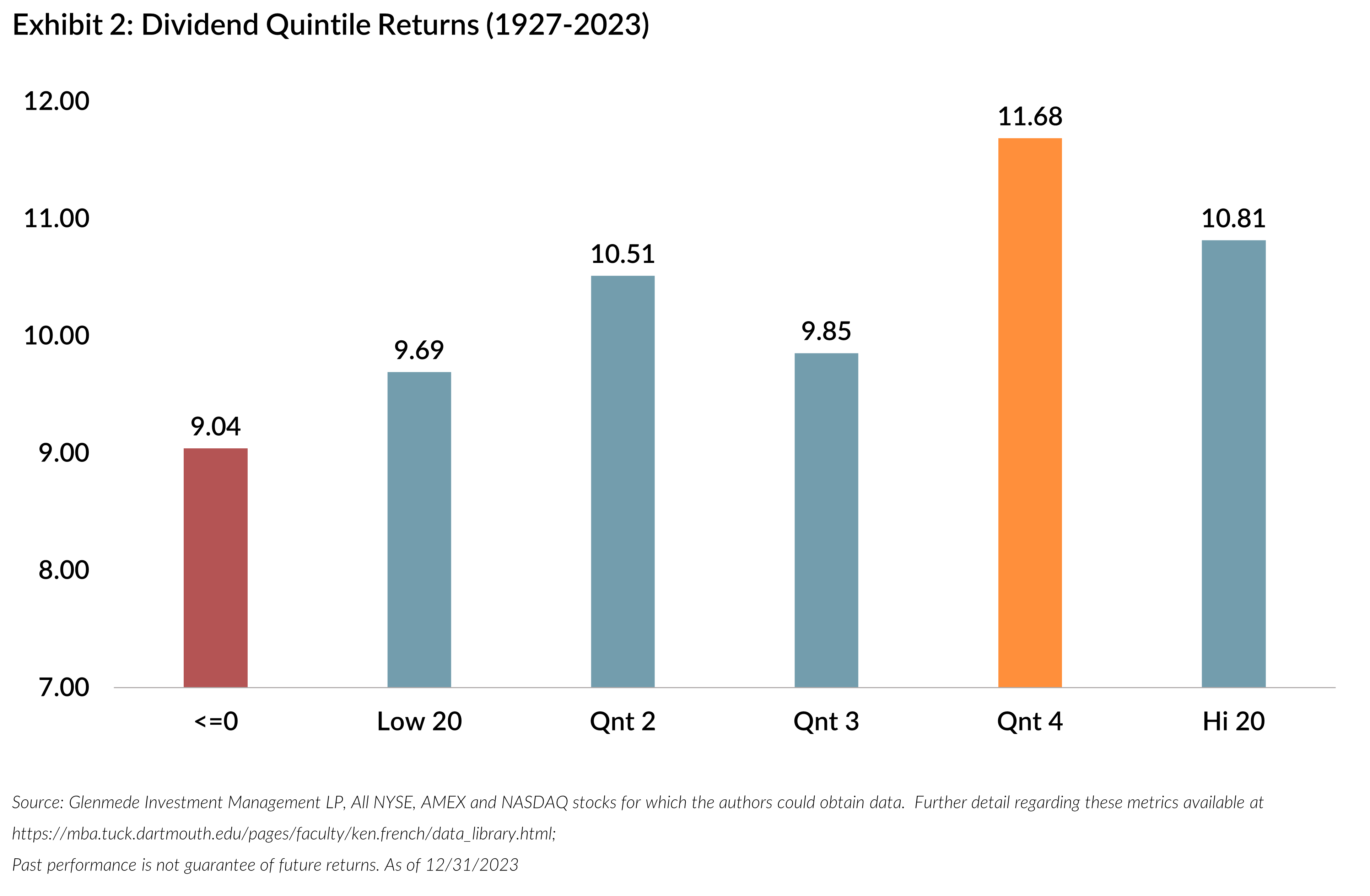

Exhibit 2 compares the returns of dividend paying stocks since 1927 split into quintiles of dividend yield. Each of the quintiles has outperformed the companies that did not pay dividends. Notably, the 4th quintile has historically delivered the best returns, not those with the highest yields as one might assume.

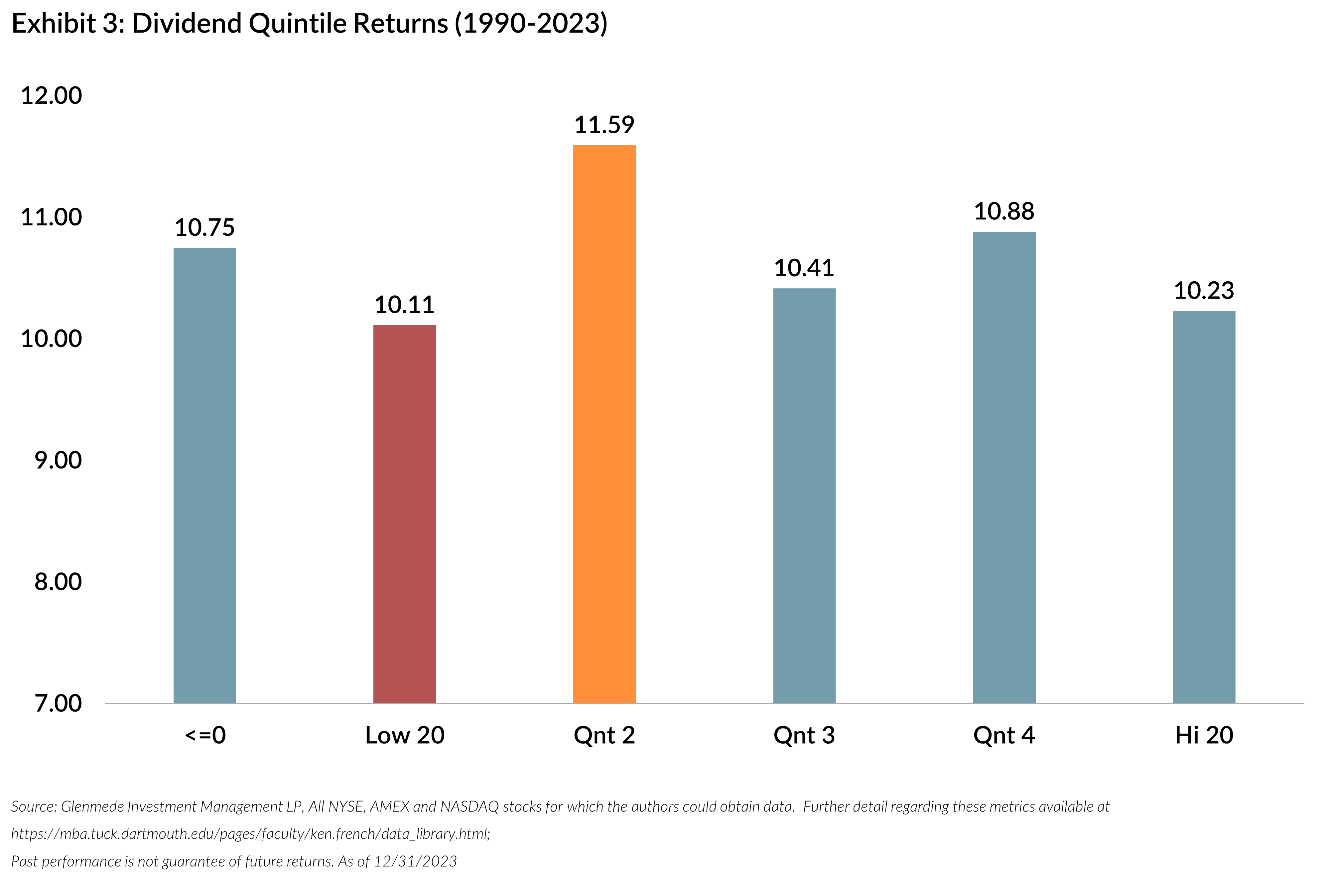

We acknowledge that dividends have played a smaller role in total returns in recent decades, as observed in Exhibit 1. But even if we narrow the analysis to only the years 1990-2023, as shown in Exhibit 3, we still see the greatest returns coming from the middle of our dividend-paying stock universe (in Quintiles 2 and 4).

Impact of Dividends on Volatility

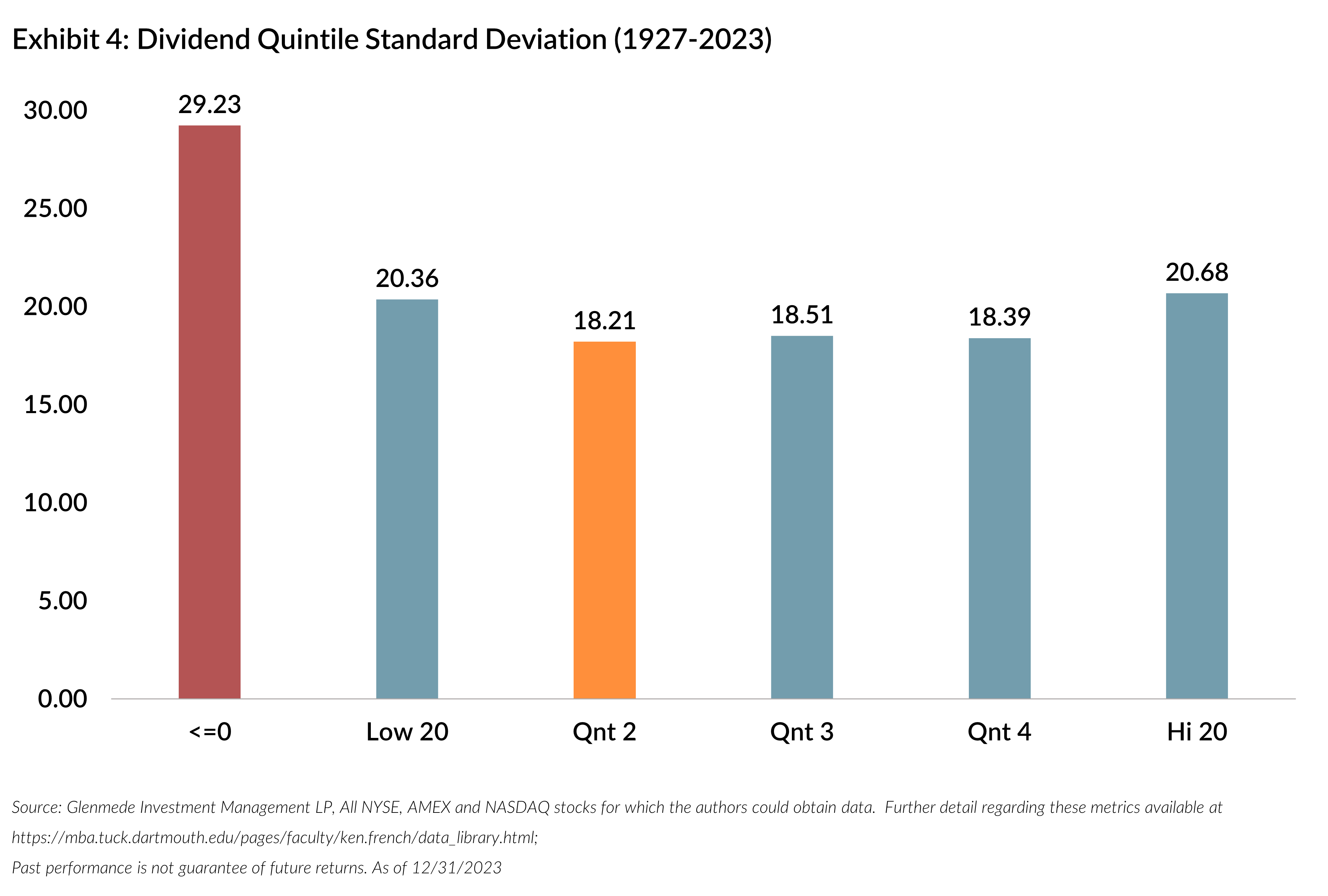

Lower volatility, a measure of risk, is another attractive characteristic of dividend paying stocks. Exhibit 4 compares the standard deviation, or volatility, of the same stock groupings since 1927. Interestingly, Quintiles 2-4 show lower volatility relative to the highest paying quintile, the lowest paying quintile and companies that did not pay dividends.

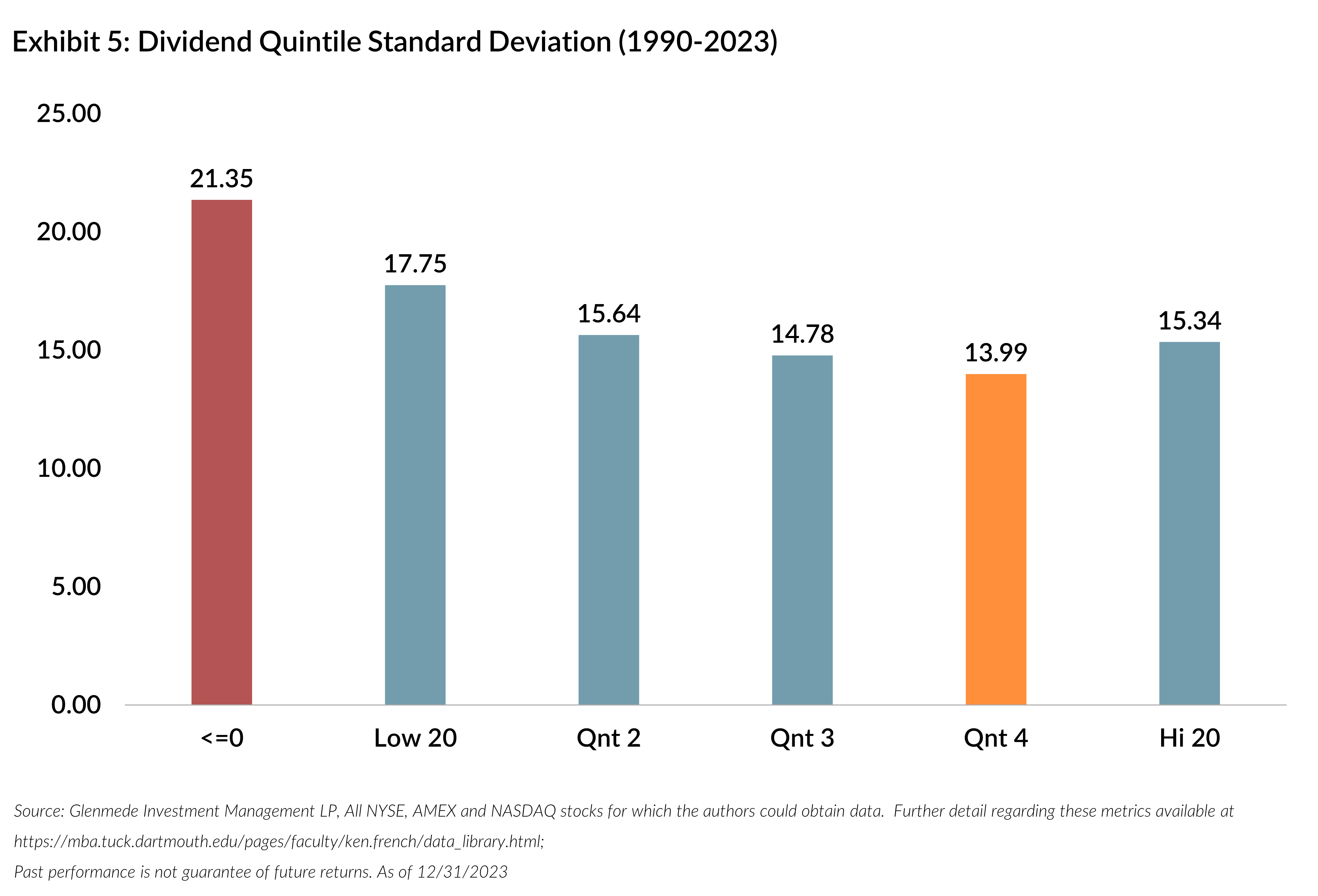

Similarly, when focusing on the more recent decades of 1990-2023, lower volatility was seen among stocks landing in the middle of our dividend distribution (with Quintile 4 the lowest).

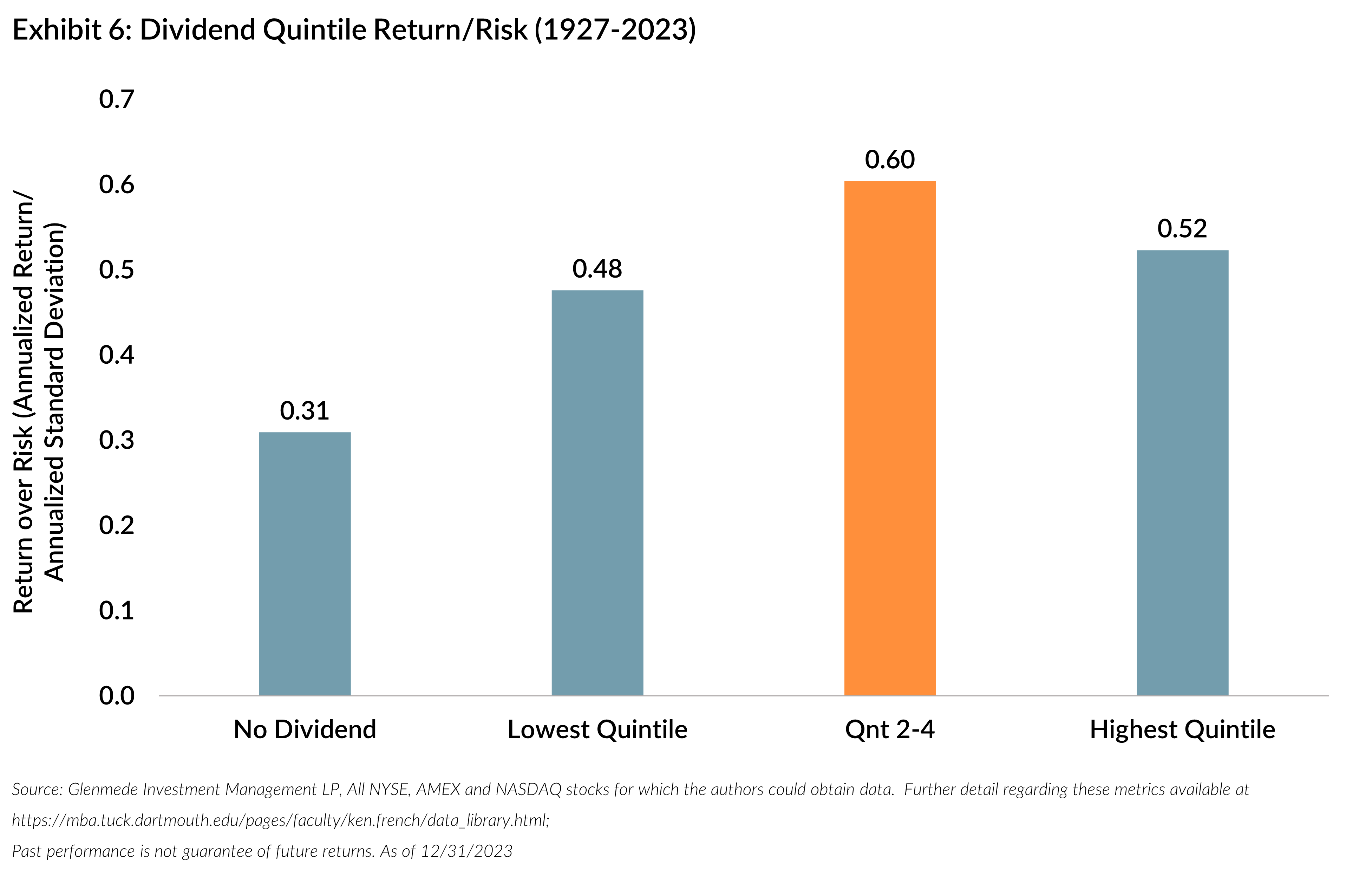

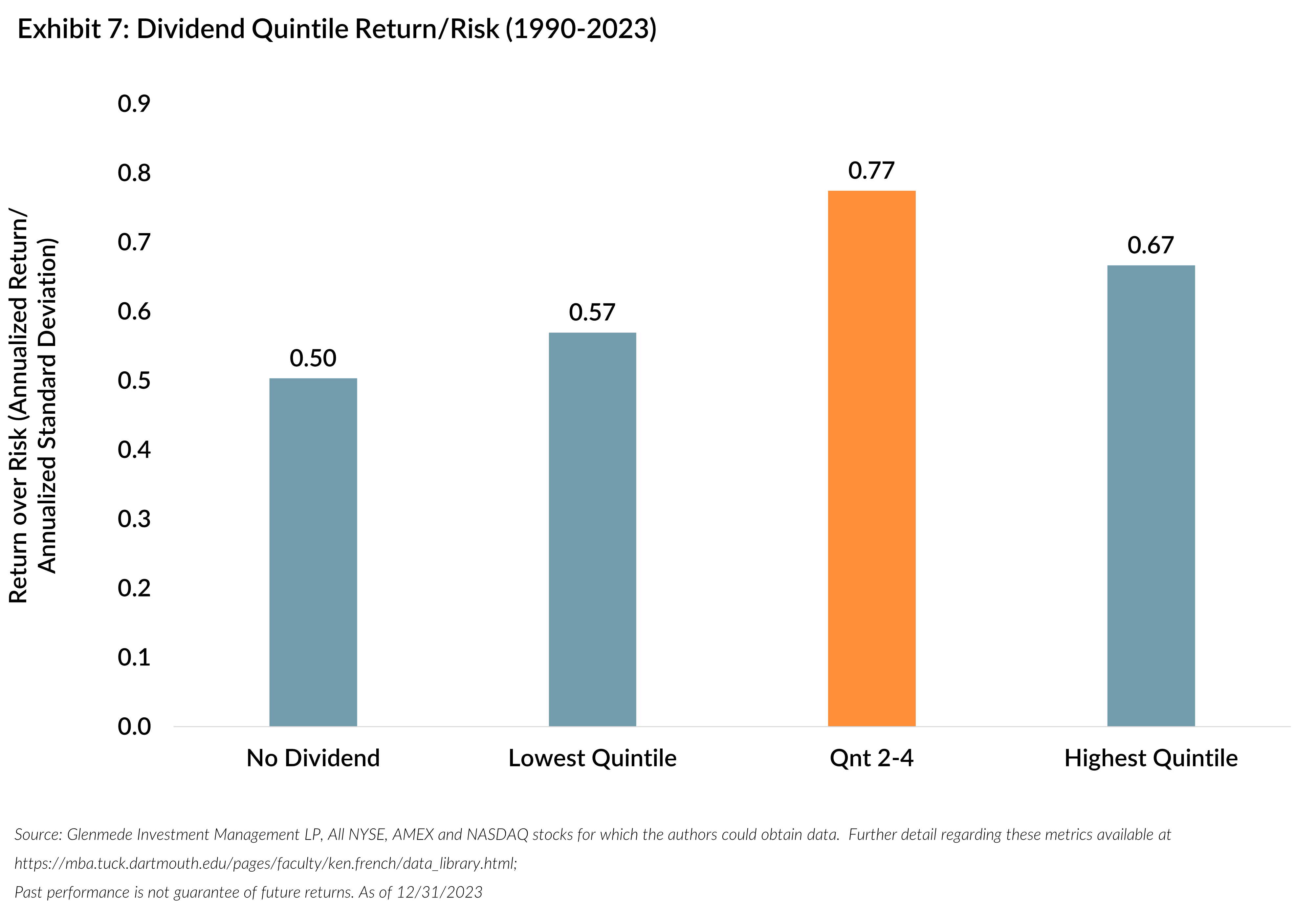

We can combine this with the return data to generate risk-adjusted returns. Exhibits 6 and 7 show the returns divided by the standard deviations to give us a view of the return per unit of risk. We aggregated the middle of our distribution (Quintiles 2-4) to help highlight their attractive characteristics versus the other groups, having generated more return per unit of risk in both time periods.

Based on this data, we believe that investors who focused on dividend stocks could have achieved attractive returns during the periods described above despite missing out on returns from non-dividend paying stocks. A strategy focused on Quintiles 2-4 may have been able to lower their risk and boost their returns, simply by weeding out stocks with the highest and lowest yields. While we all know past performance is no guarantee, we believe there are both fundamental and behavioral reasons that such a strategy could continue to reap dividends (and capital gains) for investors.

Impact of Dividends on a Business

From a business perspective, paying a dividend creates some capital discipline for managers. Early in a company’s life cycle, management teams are generally focused on a relatively small number of important investments to help grow the business. Capital discipline initially comes from relying on investors and lenders to willingly finance those investments. Even as it develops the ability to internally finance projects through its own cash flow, a successful young business often has ample opportunity to reinvest at attractive rates of return.

As a business becomes more successful and matures, it can be difficult to reinvest all the cash flow back into the business at returns above its cost of capital. We think it takes a highly disciplined management team (and, often, a willing and patient shareholder base) to hold “excess” capital and forgo growth today for better opportunities tomorrow. By returning a portion of cash flow to shareholders as dividends, management can alleviate the pressure on themselves to deploy the excess capital and instead concentrate on the best opportunities to invest in their existing business. Dividend-paying companies, therefore, may be less likely to waste capital on projects that do not leverage their strengths.

This discipline is one of the primary reasons we feel that paying dividends makes sense for many businesses and their shareholders. It is still important for the company to retain enough capital to reinvest to grow its earnings, cash flow and dividends over time. This means the dividend payout, relative to its earnings and cash flow, should be set at a level that maintains sufficient flexibility to meet reinvestment needs and growth opportunities.

Dividend paying companies are generally mature – their growth rates are likely to be more modest than those businesses who are still reinvesting most of their cash flow back into the business. However, reinvesting at strong returns on capital still allows mature businesses to grow and compound shareholder value. Many market participants focus on the next hot growth story, or the potential turn-around, that can provide substantial capital appreciation. There may be fewer that pay attention to the ‘plodders’ or those creating less excitement (volatility) and underpricing their ability to gradually compound over time (capital appreciation).

Conclusion

Our belief is that a strategy of investing in dividend paying stocks may generate strong long-term returns while mitigating some of the volatility associated with owning equities. The reduced volatility may be helpful for maintaining exposure in more difficult markets because the dividends can act as a buffer to the more dramatic pullbacks. By focusing on strong businesses that pay a reasonable dividend relative to their cash flow, an investor can balance those benefits with the need for the companies to reinvest in themselves and sustain long-term growth. Combining those dividends and long-term growth with attractive valuations creates a fertile fishing pond for investors. While these stocks may exclude the high-flyers or headline grabbing stocks, we believe the risk-adjusted returns are beneficial for longer-term investors in helping them achieve their investment objectives.

For more information on our dividend-focused investment strategy, please reach out to a member of your GIM relationship team.

All data is as of May 31, 2024, unless otherwise noted. Opinions represent those of Glenmede Investment Management LP (GIM) as of the date of this report and are for general informational purposes only. This document is intended for sophisticated, institutional investors only and is not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIM’s opinions may change at any time without notice to you.

Any opinions, expectations or projections expressed herein are based on information available at the time of publication and may change thereafter, and actual future developments or outcomes (including performance) may differ materially from any opinions, expectations or projections expressed herein due to various risks and uncertainties. Information obtained from third parties, including any source identified herein, is assumed to be reliable, but accuracy cannot be assured. This paper represents the view of its authors as of the date it was produced and may change without notice. There can be no assurance that the same factors would result in the same decisions being made in the future. In addition, the views are not intended as a recommendation of any security, sector or product. Returns reported represent past performance and are not indicative of future results. Actual performance may be lower or higher than the performance set forth above. For institutional adviser use only, not intended to be shared with retail clients